BAV (Bank Account Verification) UI User guide

This project was centred around me maintaining Product management responsibilities for one of the identity-based backing services at Experian known as Bank Account Verification which was connected to a product called CrossCore. CrossCore is an open API/UI plug-and-play product that integrates all data and Identity/fraud services into a unified platform. As newly launched product within Experian, I had to create the user guide containing step-by-step instructions for clients on navigate around the CrossCore UI and have a contract for the BAV services.

The Bank Account Verification Consumer/Commercial services comprises of 3 CrossCore backing services:

-

Bank Account Validate - checks the format of account details so that the details are for an open bank/ or branch

-

CRP Get Data - obtains the data from the Experian Bureau using provided sort code and account number

-

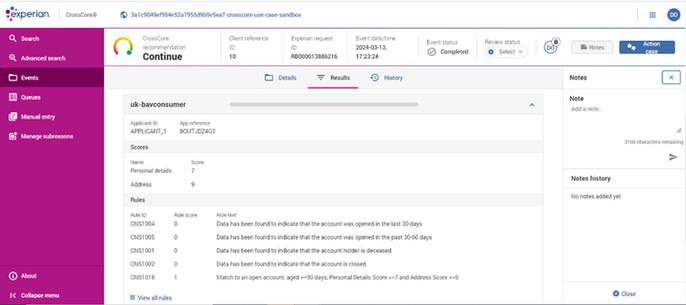

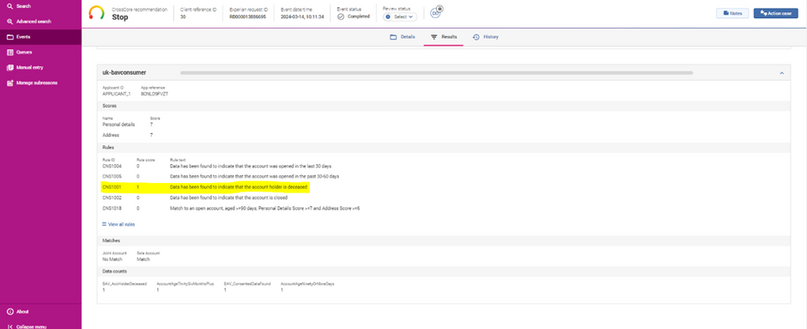

BAV Consumer/Commercial service - evaluating rules that have been pre-configured on the platform and provide personal details and address scores

The UI user guide enables not only the clients instructions navigating around BAV Consumer/Commercial service on the CrossCore but also provided support for the following internal stakeholders at Experian when the product was launched to market:

-

Account Managers

-

Sales Specialists

-

Client-Training Department

Examples of Scenarios created:

Scenario 1: A Successful BAV Consumer transaction

Scenario 2: A transaction where account holder is deceased

Scenario 3: A transaction where account holder's Registration number did not match resulting in a 'Refer' decision